We introduce Panoramic Governance, a new mechanism that incentivizes governance participation and protocol growth within Layer 2 blockchains. Panoramic Governance can be implemented on any Layer 2 blockchain with a native governance token and a sequencing system where users pay gas fees for faster transaction ordering and trusted pre-confirmations.

Panoramic Governance (PG), is a novel mechanism designed to incentivize both governance participation and protocol growth within Layer 2 blockchains. PG can be implemented on any Layer 2 blockchain that has a native governance token and a sequencing system where users pay gas fees for faster transaction ordering and trusted pre-confirmations of their transactions.

PG creates a value-aligned ecosystem, ensuring that all blockchain actors—users, protocols, and chain operators—are correctly incentivized.

PG has two interdependent systems: one that distributes sequencer fees to participants who actively engage in the network and vote in governance, and another that enables governance participants to allocate token emissions to protocols operating on the blockchain. As protocols drive demand for block space, they increase sequencer fees. This results in greater earnings for active governance voters, who are then motivated to allocate more token emissions to the most successful and contributing protocols on the network.

Governance plays a critical role in any decentralized network and is a foundational pillar of Panoramic Governance (PG). Active governance token holders are the recipients of sequencer fees, incentivizing meaningful participation.

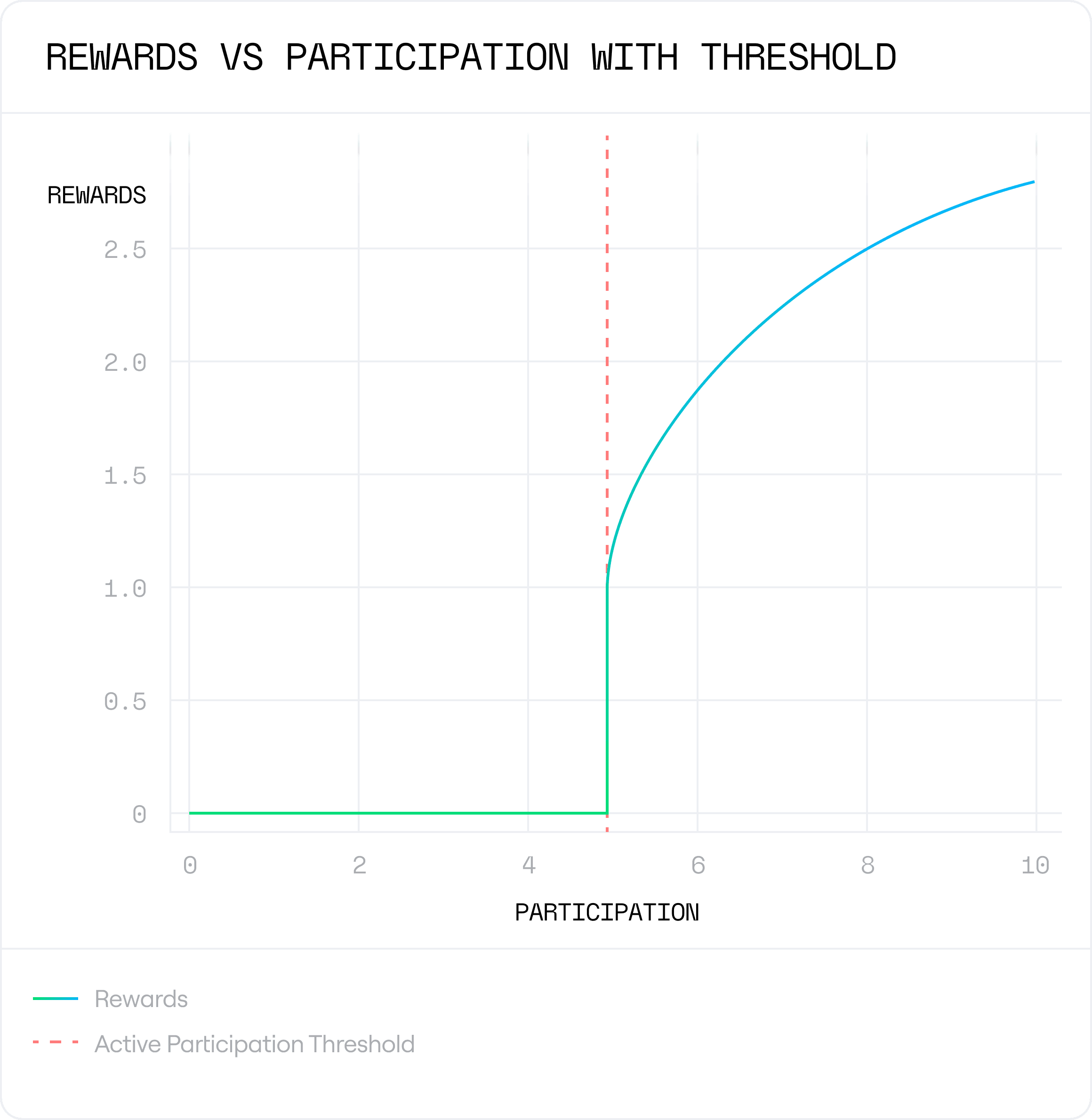

Networks will define what an “active” participant is by creating a heuristic called the Active Participation Threshold (APT). This heuristic could be based on factors like the number of transactions exceeding a certain threshold, the total value of transactions submitted, or any other criteria the network chooses. The key point is that only participants who are actively benefiting the network receive sequencer fee rewards.

Inspired by Curve Finance's gauge mechanism [0], the network allocates a portion of tokens to distribute across various protocols, supporting their growth. Governance participants vote each epoch to decide how these emissions are allocated to each protocol. Successful protocols gain a larger governance stake and, in turn, a greater share of the sequencer fees generated.

New protocols can accelerate their growth by offering "liquid bounties" as an incentive for governance participants, encouraging them to allocate more emissions to their protocol.

Panoramic Governance harmoniously integrates these two key incentive systems: Active Governance Participation, the first mechanism to distribute sequencer fees, and Ecosystem Emissions, a system designed to bootstrap protocol growth by rewarding protocols that contribute the most to the network.

Blockchain participants are incentivized to not only act in the best interest of the network but also to participate in governance to vote for protocols that either demonstrate significant contributions to the network or offer the most attractive liquid bounties.

On the other hand, protocols are motivated to maximize their contributions to the ecosystem, as doing so enables them to receive a larger share of emissions from governance participants.

Together, Panoramic Governance unifies these two interdependent systems into a closed, self-sustaining flywheel. This "closed flywheel" ensures sustainability by drawing from a predefined allocation of capital (sequencer fees and set allocation of network tokens), minimizing the risk of unsustainable token inflation or excessive emissions.

By implementing the system described above, we can create a dual module structure that rewards active network and governance participants while simultaneously promoting ecosystem growth. Each module can operate independently to drive network adoption, but together they work symbiotically to align the interests of token holders, onchain protocols, and chain operators and users, fostering sustainable and robust ecosystem development.

The dual module system operates in a closed environment without relying on artificial token inflation. All rewards are sourced directly from a predefined tranche of tokens and capital that is injected into the system through sequencer fees.

You can find the full whitepaper here.